Retirement Readiness Roadmap

Arvest offers wealth management tools and tips that help you create a long-term strategy for confidence, even in the current economic climate.

Story by Ann Butenas

Someone once quipped when the time came to retire, it would be so easy to just say “no:” no job, no stress, no pay! Well, for those who are anticipating retirement, whether in a year, five years, 10 years, or more, it is something well worth considering in terms of financial preparation for such a significant change in life.

With inflation and rising interest rates, your dreams of retirement may not look the same as you originally had hoped or planned. You may be tentative about retiring and perhaps have lost confidence in the stability of your financial plan and your ability to comfortably retire with the lifestyle you intended and desire.

If you have questions about retirement and your ability to even consider turning the page in that regard, the wealth advisors at Arvest Trust & Wealth Management can help you comfortably navigate this journey with their approach to financial freedom and security. With a broad range of financial planning, investment, insurance, and trust services, Arvest has the tools and resources to help you secure your financial future.

Are you saving enough for retirement?

It’s no secret the current economy has suffered some major setbacks in recent months. That alone has caused those on the cusp of retirement to consider pushing that long-anticipated date back a bit. Perhaps you are not even sure if you should retire when you had planned to do so. Maybe you are even wondering if you should work a bit longer to make up for current losses. The short answer is that it all boils down to your own unique situation.

“The response to this question varies based on your personal financial situation, your retirement income needs, and preferences,” explained Brett Larson, Vice President, and Trust Wealth Advisor with Arvest. “Current market losses may not be as negatively impactful if your retirement horizon is three to five years out and market losses hurt most when you need immediate distributions from investments, especially on the front end of retirement. We can help you create a financial plan that helps mitigate that risk of distributing money when the market goes down.”

“The response to this question varies based on your personal financial situation, your retirement income needs, and preferences,” explained Brett Larson, Vice President, and Trust Wealth Advisor with Arvest. “Current market losses may not be as negatively impactful if your retirement horizon is three to five years out and market losses hurt most when you need immediate distributions from investments, especially on the front end of retirement. We can help you create a financial plan that helps mitigate that risk of distributing money when the market goes down.”

No matter in what state the economy is, it’s easy to question whether or not you have even saved enough for retirement. Again, the answer to this is based on your projected needs during retirement and your anticipated retirement time horizon.

“The varying types of accounts you have and how they are taxed, and your overall health can impact how much you need to save for retirement,” emphasized Larson. “This is a basic answer we can provide our clients by going through the financial planning process.”

No matter what your situation is or what the situation of the economy is, Arvest can help you find a path that fits your needs and personal financial situation.

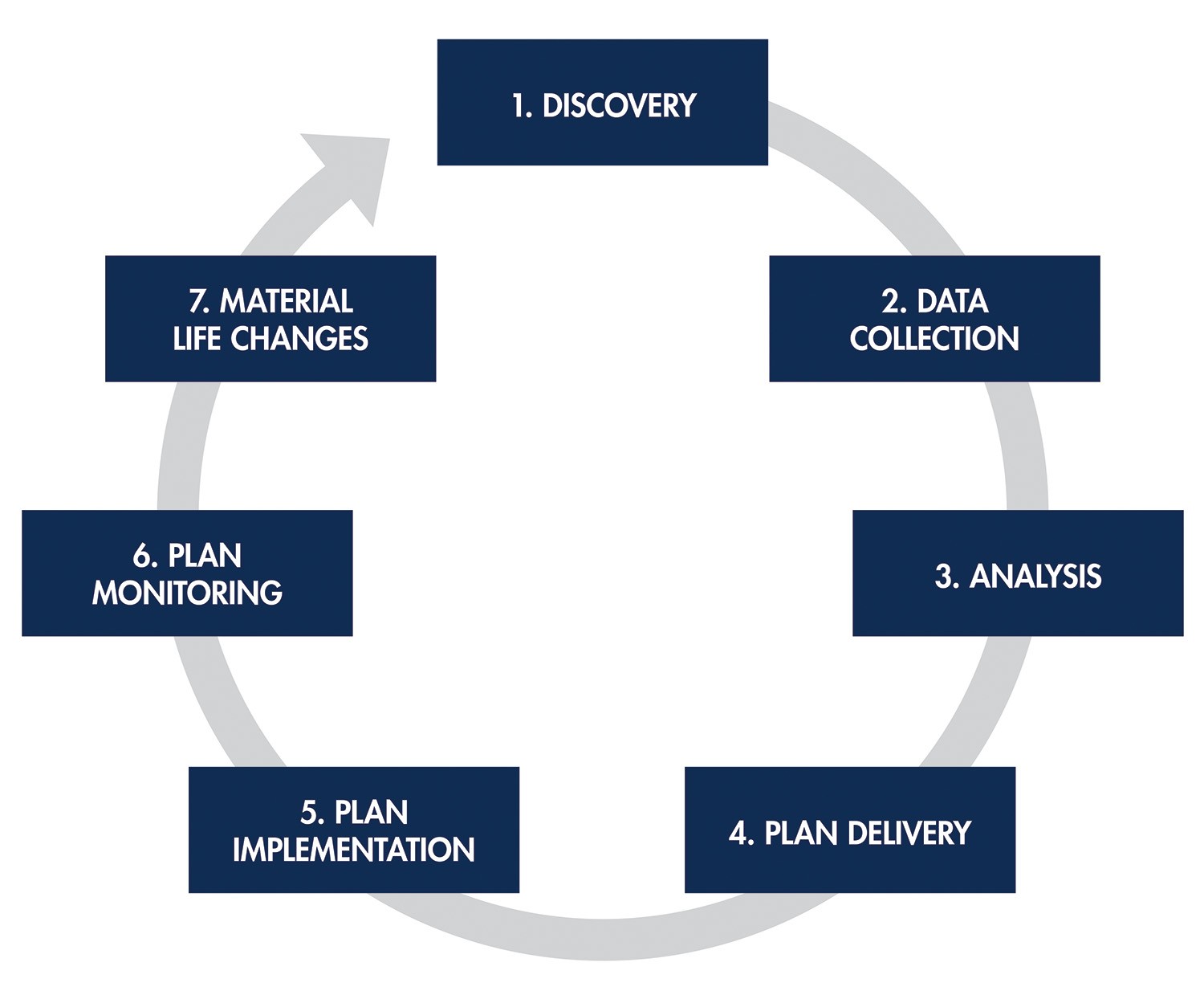

OUR FINANCIAL PLANNING PROCESS

Investment products and services provided by Arvest Investments, Inc., doing business as Arvest Wealth Management, member FINRA/SIPC, an SEC registered investment adviser and a subsidiary of Arvest Bank. Insurance products made available through Arvest Insurance, Inc., which is registered as an insurance agency. Insurance products are marketed through Arvest Insurance, Inc., but are underwritten by unaffiliated insurance companies. Trust services provided by Arvest Bank.

Main considerations when setting up a retirement plan

When preparing for your retirement, you undoubtedly have many questions and concerns. In order to properly lay the foundation, you have to understand your needs, wants, and wishes and how you choose to prioritize them. This should also factor in your preferences today and how those preferences could change in the future. The experienced advisors at Arvest can help you navigate all the essential elements of your plan.

“I often use the example when clients say they want to retire in Florida in 15 years and they want to buy land today because it makes sense economically. But what often happens is life,” explained Larson. “Your kids move to California and your best friends move to Texas and now you actually want to live somewhere in between. Our planning solutions we provide will give you the flexibility you need as your preferences change over time.”

So, bearing this all in mind, is there a way to coordinate your entire financial situation? According to Larson, it is of utmost importance to have full plan coordination when preparing for the future. Full plan coordination considers an individual or a family’s planning needs, including retirement planning, incapacity planning, risk management and expenses, business succession planning, drawing income and more.

“We want to make sure your planning needs are comprehensively covered to account for any potential gaps or overlaps regarding your specific situation,” expressed Larson. “Having ‘plan coordination’ is the focal point of our discussion with every client to make sure we concentrate on what is the most important to them but is also in concert with identifying and discussing areas they may not have recognized.”

Five Reasons to Create a Retirement Plan

1. To help you focus on your retirement goals and how you intend to pay for them.

2. To address your concerns and expectations for retirement.

3. To identify things that could pose a potential threat to your retirement and understand how to manage them.

4. To feel more educated, informed, confident, and in control of your financial future.

5. To help you navigate the complexity of financially moving into that next chapter of life: retirement.

It’s never too late to think about tomorrow

No matter where you are on the retirement timeline, it is never too late to begin a conversation with a trusted advisor regarding your personal financial situation.

“Financial planning is about more than assets, investments, and net worth,” stated Larson. “It’s truly about what is most important to you, identifying your concerns, expectations, and goals. We can assist in addressing common fears and concerns such as health care costs, outliving your money, and the best time to file for Social Security benefits.”

The team at Arvest Trust & Wealth Management can help you determine how likely you are to reach your goals and also to help you identify any potential gaps or overlaps within your plan.

“When we understand your retirement goals, we can help you create a plan to make the most of your money,” indicated Larson.

Arvest Trust & Wealth Management, visit them online at arvest.com/wealth

Investment products and services provided by Arvest Investments, Inc., doing business as Arvest Wealth Management, member FINRA/SIPC, an SEC registered investment adviser and a subsidiary of Arvest Bank. Insurance products made available through Arvest Insurance, Inc., which is registered as an insurance agency. Insurance products are marketed through Arvest Insurance, Inc., but are underwritten by unaffiliated insurance companies. Trust services provided by Arvest Bank.